4.19.24

Dear OWL Users,

This week, we’ll look at recently disclosed changes and updates to Yale’s manager roster. OWL users can see full details on Yale's Profile Page in OWL.

OWL’s allocator database tracks publicly disclosed manager investments and other information for 2,000+ allocators, up from just a few hundred when we first profiled Yale’s portfolio a year ago. We continue to add more allocators and managers to OWL every week.

As a reminder, OWL’s allocator data comes from a large number of obscure sources – retirement plan disclosures, foundation tax forms, government websites, FOIA requests, etc. – and is often unstructured, difficult to find, and takes time to clean and organize properly. We are confident that OWL is the highest quality source for endowment and foundation disclosures, and our users can track the investments of other leading endowments like Stanford, Duke, Wash U, Michigan, UTIMCO, Cal, and MIT here.

Yale’s Manager Roster

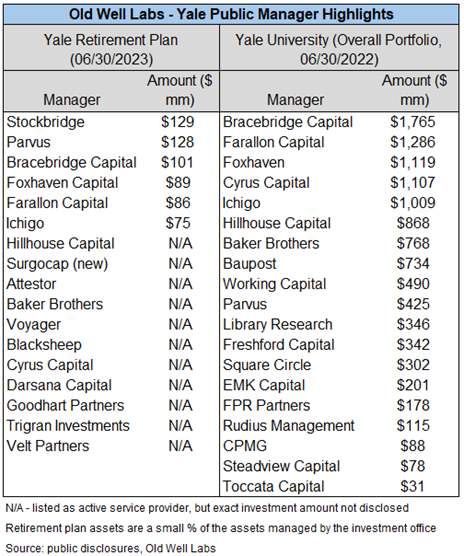

Yale discloses investments in multiple regulatory filings, including one for the school’s retirement plan, which the Yale Investment Office manages. That entity recently released an update that disclosed a new investment in SurgoCap, launched by Lone Pine alum Mala Gaonkar. A selection of Yale’s public managers disclosed in the filings is below:

One longstanding Yale manager is Baker Brothers, a biotech fund that was featured in this week's WSJ for its windfall profits after Pfizer acquired Seagen. The WSJ reported several specific data points about Baker’s performance and business, so we thought we would compare those to the data we have in OWL for the manager.

First, we can compare returns reported by the WSJ to OWL’s estimates based on public disclosures:

- 2021 return: -25% (WSJ), -23% (OWL)

- 2022 return: -19% (WSJ), -17% (OWL)

- 2023 return: +19% (WSJ), +25% (OWL)

It is not uncommon for OWL’s return estimates to be slightly ahead of official returns since OWL does not account for fees and expenses, and that gap can be larger in positive years due to performance fees.

The WSJ estimates each brother to be worth $2.8 billion. With our new internal ownership data, OWL users can see that Baker Brothers as a firm has $4.5bn of internal capital invested in its funds, the majority of which is likely Felix and Julian’s.

The WSJ also reports that the Seagen sale reaped $10 billion in proceeds for Baker Brothers. With OWL’s cumulative P&L chart, users can easily see that activity on the yellow line below:

Note: Returns are OWL estimates based on publicly disclosed long positions; actual manager returns may vary

Finally, the WSJ reports that Baker Brothers’ LPs include Yale, Princeton, and the Teacher Retirement System of Texas. OWL has 22 unique LPs listed that have disclosed investments with Baker Brothers, including Boston Children’s Hospital, MIT, RIT Capital, and the University of Pennsylvania.

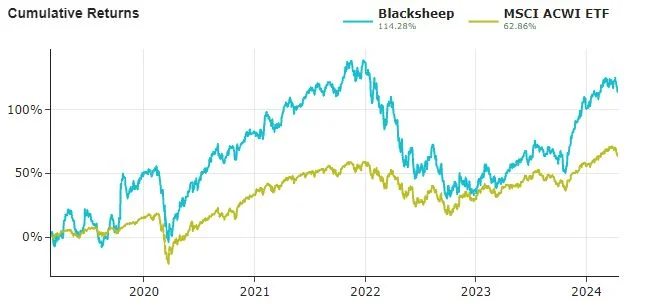

Another disclosed manager investment for Yale is Blacksheep, a Dublin-based global equity fund launched in 2018 by Alex Fortune. In addition to Yale, Boston Children’s and the GHR Foundation are disclosed investors in the fund.

OWL estimates that Blacksheep has generated strong returns since launch, with large positions in KKR and Canadian software company Lumine driving the results:

Note: Returns are OWL estimates based on publicly disclosed long positions; actual manager returns may vary

This week, an article reported that Blacksheep and Engine Capital had started an activist campaign against another Canadian software company, Dye & Durham. Engine and Blacksheep have nominated four people for the board, including Alex.

Blacksheep discloses most of its positions publicly, although this was the first place we have seen a public disclosure of Blacksheep’s involvement with Dye & Durham. While we wouldn’t be surprised to see an additional ownership disclosure come out soon, situations like this are one reason we plan to add manager-based news to OWL (including via customized email alerts). More on that in the coming months!

Recent Buys / Sells:

- Pandora A/S – Parvus bought shares in the Danish jeweler, disclosing a 5% stake on April 15th.

- Liberty Sirius XM – Berkshire Hathaway added to its position with purchases on April 12th.

- Acrivon Therapeutics – RA Capital disclosed a purchase of 3.5 million additional shares on April 11th.

- MasterCraft Boat Holdings – Coliseum Capital bought shares between April 10th-12th, bringing its stake in the company to over 13%.

Please reach out anytime with questions, comments, suggestions, or ideas!

-The OWL Team

About Old Well Labs (OWL)

OWL is an intelligence platform built for allocators, by allocators. Leading endowments, foundations, and family offices use the system to find, monitor, and connect with thousands of fund managers globally. OWL's analytics engine has collected over one billion data points from 65 countries. We make it easy for allocators to find and track information about the managers they care about – not just positions but also performance analytics, people data, business information, and details about the manager investments of other allocators.

Please feel free to selectively share these updates with high-quality allocators who might be interested in learning more about the system.

Reach out to learn how OWL can help you find, monitor, and connect with fund managers globally