Two Newly Disclosed MIT Managers

At Old Well Labs, we pride ourselves on having the most timely and accurate data on the disclosed manager holdings of leading allocators. Recently, we discovered two newly-disclosed manager relationships for MIT that we believe are not currently shown on any other platforms. Both appear to be representative of MIT’s focus on small and emerging managers.

Allocator filings are one of several ways to identify promising emerging managers on OWL – users are also able to see new ADV filers , new 13F filers , and team change alerts , helping them identify interesting managers before they are discovered by peers.

Meditation Capital

Meditation Capital was founded in 2022 by Timothy Liu . The firm reports $32 million in AUM, and filings show that MIT represents about $9 million of that. Prior to Meditation, Liu was Head of Asia at Third Point and Head of Consumer and Tech at Scopia Capital . Meditation is a long-only manager focused on quality companies, and they publish their letters publicly on their website. While the firm is currently too small to file most typical ownership filings (e.g., 13Fs), we’re able to get some insight into its positions through its letters, including positions in Lottomatica (an Italy-based B2C gambling operator where Parvus is also an investor), Kaspi (Kazakhstan-based fintech company), and PDD Holdings.

Timothy Liu

Titanite Capital

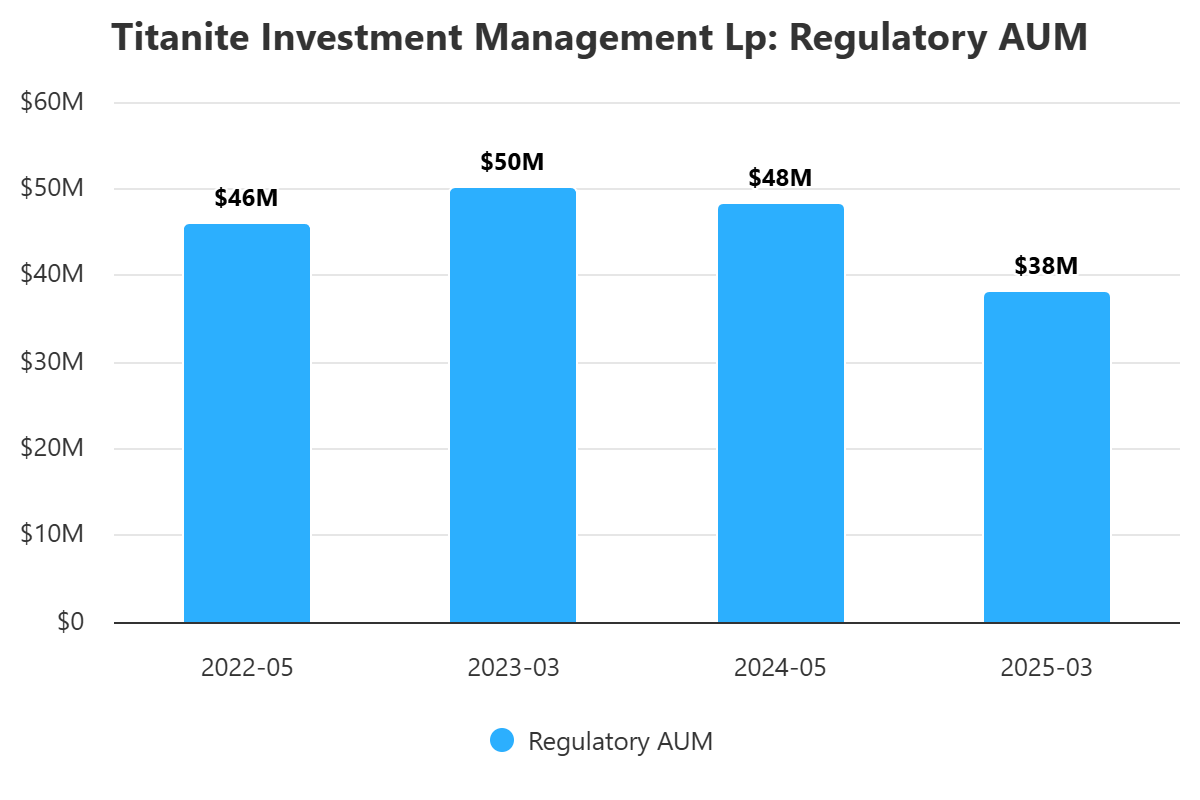

In FY24, MIT invested $10 million in Titanite Capital , a Connecticut-based manager focused on small and mid-cap biotech and med-tech investments. The firm was founded in 2021 by Dr. Eric Varma and has remained relatively small since launch:

Varma was previously a partner at Oracle , another small Greenwich-based healthcare fund. The firm only lists 3 employees; Paul Kwong , its Director of Trading, also came from Oracle.

Eric Varma, MD

In addition to surfacing the managers above, the latest MIT filing showed a $27 million redemption from Hillhouse , where MIT’s disclosed investment has continued to decline.

For more details on MIT’s entire portfolio, OWL users can see the full portfolio on MIT’s profile page , with additional analysis in our most recent MIT Insights.

Recent Buys & Sells

Daktronics – Alta Fox reduced its position by 17% in the electronics company. The fund still owns 9.5% of the shares.

TheRealReal – Woodson Capital increased its position in the online luxury goods retailer by 16% on 5/27

NEL – Ennismore increased its short position to 1.2% of the Norway-based hydrogen company on 5/30

Universal Technical Institute – Coliseum reduced its position in the workforce education company by 16% on 5/27

Other News & Events

Inside $18 billion CFM's evolution to quant giant (includes OWL data!)

Yale Nears Deal to Sell $2.5 Billion of Private Equity Stakes

Hedge funds spotlight China robotaxis, Indian pharma, and Korean nuclear plays at Sohn Hong Kong

Macro hedge funds top allocator wishlists, says SocGen survey

How a $50M loan to CoreWeave became Magnetar Capital’s boldest bet

Please reach out anytime with questions, comments, suggestions, or ideas!

-The OWL Team

About Old Well Labs (OWL)

OWL is an intelligence platform built for allocators, by allocators. Leading endowments, foundations, and family offices use the system to find, monitor, and connect with thousands of fund managers globally. OWL's analytics engine has collected over one billion data points from 65 countries. We make it easy for allocators to find and track information about the managers they care about – not just positions but also performance analytics, people data, business information, and details about the manager investments of other allocators.

Please feel free to selectively share these updates with high-quality allocators who might be interested in learning more about the system.

Reach out to learn how OWL can help you find, monitor, and connect with fund managers globally